for the same coverage amount and policy length.

for the same premium and benefit

for the same premium and policy length.

Earn commission on life insurance multiple times

and help your client improve their coverage over time

Don’t have copies of existing policies? We can help retrieve them for you and take the administrative work off your plate.

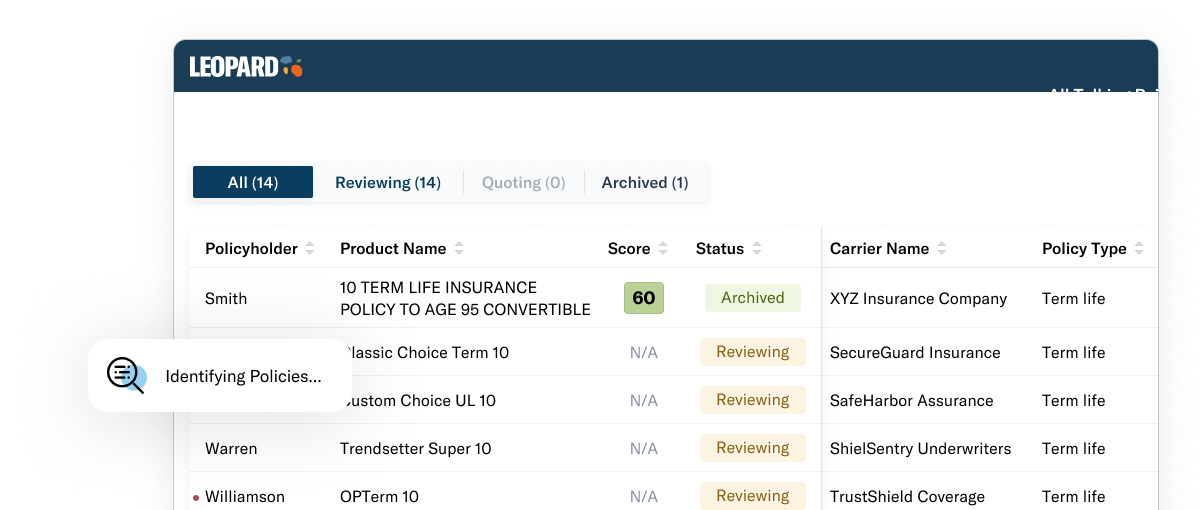

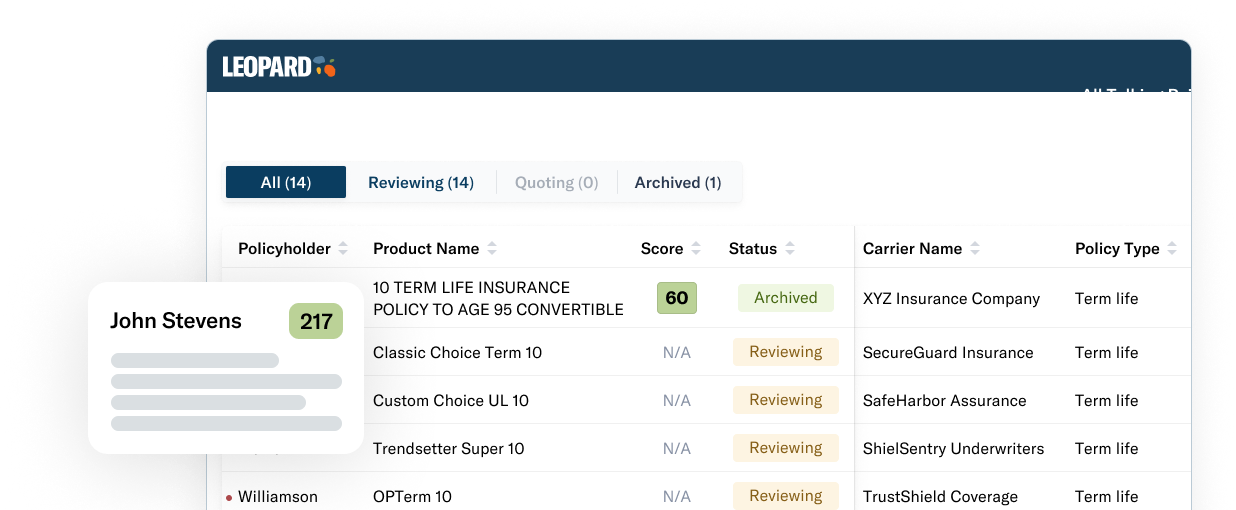

Leopard’s AI analyzes your book of business, extracts key policies information and identifies other coverage options on the market.

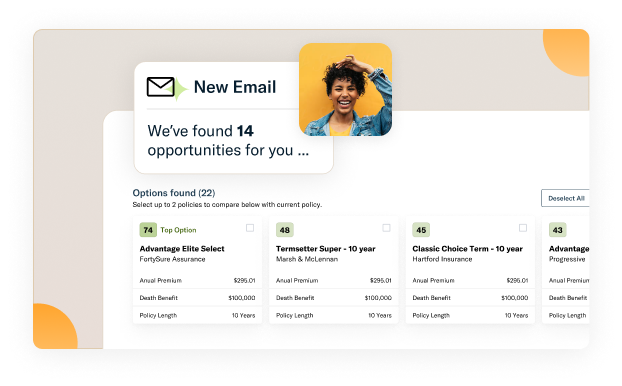

See your replacement, up-sell and cross-sell opportunities in one place. Easy-to-understand scores highlight which customers represent your strongest revenue opportunities.

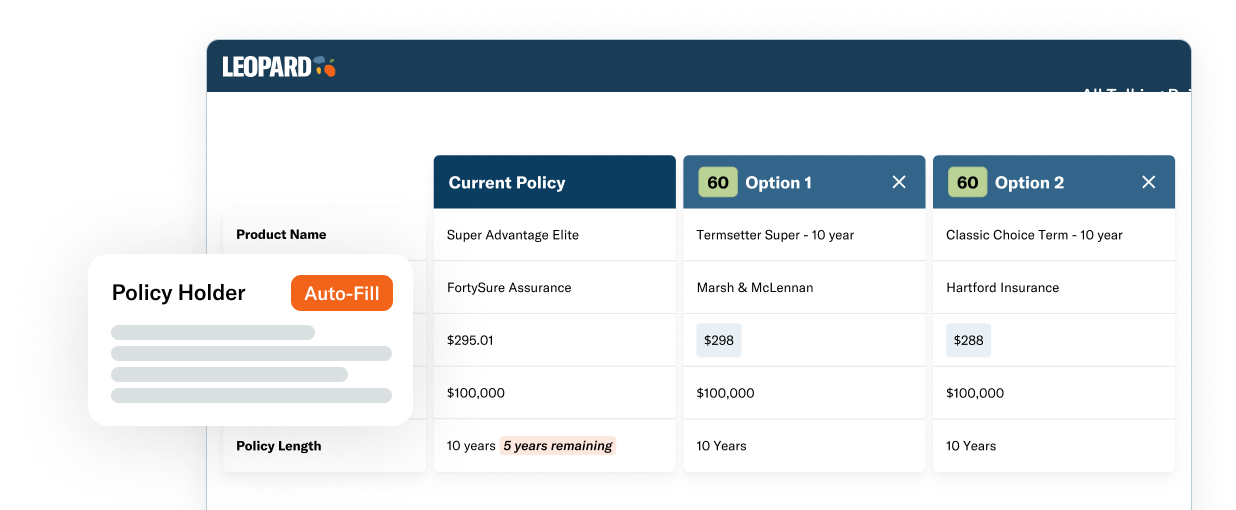

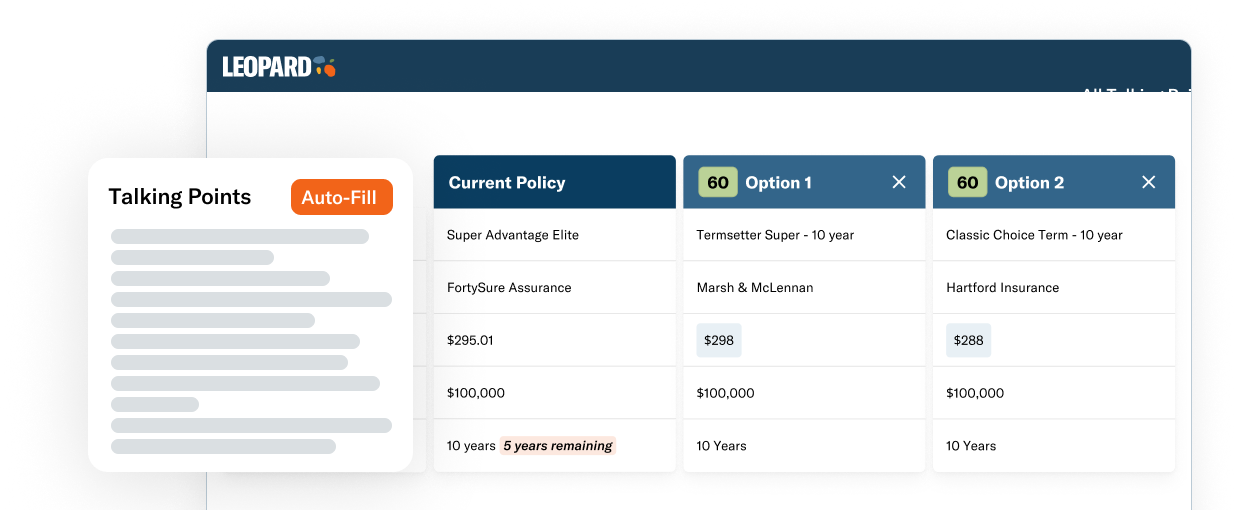

A robust range of quotes from top carriers means you’ll never miss an opportunity. Use the policy comparison table to see top options side-by-side.

Elegant AI-generated summaries of coverage options let you quickly send emails to clients or speak to the key benefits of various options on a call.

Upload a copy of your client’s policy when a policy review is coming up to make sure they have the best coverage available to them. Even if they don’t, showing them you’re always on the lookout for the right coverage makes you a trusted partner.

Let Leopard work in the background. Add your entire book of business to the platform, and Leopard will alert you when a revenue opportunity presents itself.

We take privacy very seriously and have a range of protocols in place to ensure any data you enter into the system is fully protected. We have business associate agreements with AI vendors and have cloud providers take many precautionary measures to ensure data is safe.

Yes! We can help you retrieve copies of your policies or manually enter data into the system.

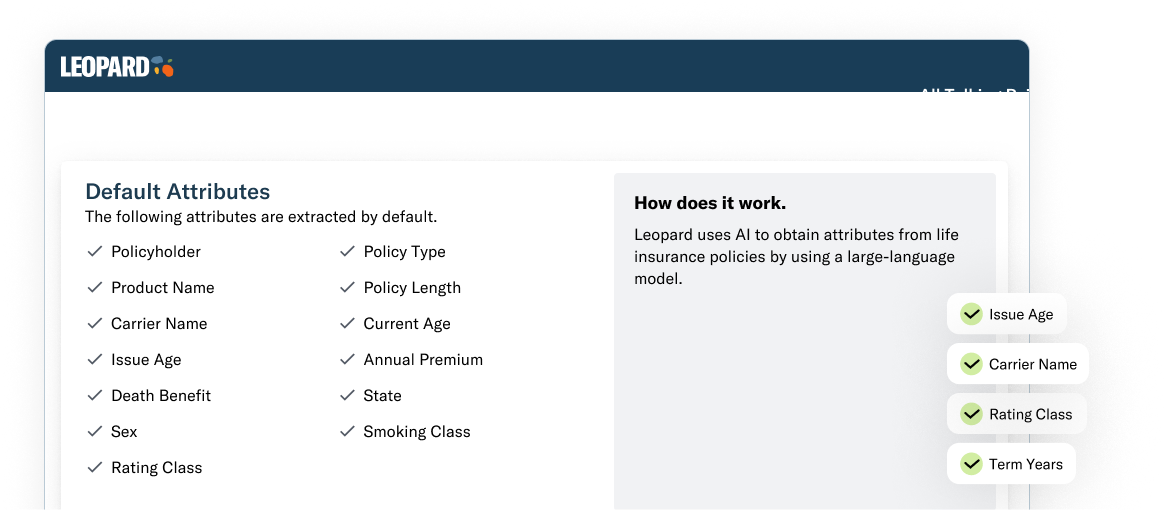

This gets into the secret sauce, but fundamentally we use AI to extract policy attributes (e.g., premium, length of coverage, death benefit, etc.) and compare those attributes against the attributes of policies available from 40+ leading carriers. The score reflects how much stronger other policy options are with respect to those attributes.

The average manual policy review takes 15-20 minutes. Leopard takes 10-15 seconds per policy. Plus, Leopard is always looking for opportunities, while policy reviews typically only happen once or twice a year.

Enter your information below to see Leopard in action.